In a major vote of confidence from international investors, Kenya has successfully raised $1.5 billion (Ksh.193.8 billion) from the global financial markets, a move that also allows the country to pay off a significant portion of its looming 2024 Eurobond debt ahead of schedule.

The transaction, announced by the National Treasury on Friday, was met with overwhelming demand, attracting over $7.5 billion in bids from global investors—five times the amount the government was seeking.

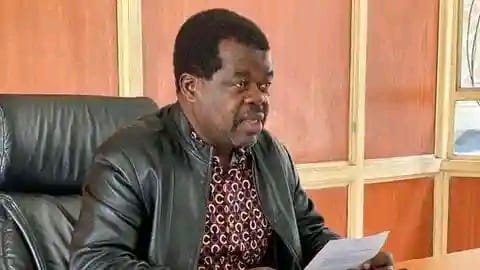

Treasury Principal Secretary Chris Kiptoo hailed the deal as a critical achievement for the nation’s economic stability. “This is the third such transaction since 2024, and it shows the Government’s firm commitment to managing debt more wisely, paying off loans on time, and protecting Kenyans from sudden repayment shocks,” Kiptoo stated.

The new funds were raised in two parts: a 7-year loan with an interest rate of 7.875% and a 12-year loan at 8.8%. According to PS Kiptoo, this combination results in a blended interest rate of 8.7%—a full percentage point lower than what Kenya would have paid for a similar issuance earlier in the year. This lower rate translates directly into millions of dollars in saved interest payments.

Crucially, the deal is structured to provide immediate fiscal relief. A portion of the proceeds will be used to retire $1 billion of the high-profile $2 billion Eurobond maturing in June 2024, a debt that has been closely watched by economists and investors as a potential risk to Kenya’s economic stability.

“By securing this deal, the Government has also smoothened and lengthened loan repayments, giving Kenya more breathing space in managing its finances,” Kiptoo explained.

The robust investor appetite, particularly from trusted fund managers in the United States and the United Kingdom, signals a renewed international belief in Kenya’s economic trajectory. “Most of this support came from trusted international fund managers in the United States and the United Kingdom, showing that the world has renewed confidence in Kenya’s economy,” the PS noted.

The successful bond issuance is expected to have a tangible impact on the ground. The government asserts that this financial maneuver will ease pressure on taxpayers, help maintain macroeconomic stability, and create crucial room to fund national development priorities.

As stated by the Treasury, this success means Kenya will “spend less on interest, ease pressure on taxpayers, and keep the economy stable while creating room to fund development priorities such as roads, health, and education.”

This strategic debt management operation effectively turns a page on one of Kenya’s most pressing financial challenges, replacing a short-term, high-pressure liability with longer-term, more manageable debt and reinforcing the country’s standing in the international capital markets.